Osborne’s symbol of turning a corner

Posted: September 9, 2013 Filed under: Affordable housing, Economics, Help to Buy, Housing market 5 CommentsThe venue for George Osborne’s speech claiming that the economy is ‘turning a corner’ may turn out to be a symbol of rather more than the economic recovery he had in mind.

The Chancellor was speaking at One Commercial Street, a half-finished 21-storey development of shops, offices and homes on the edge of the City of London and his choice of venue was no accident:

‘You’re probably thinking that a construction site is a strange place to make a speech. But I’ve invited you here for a reason. This development – 1 Commercial Street – began in 2007. The plan was to turn this building into 21 floors of office space, private apartments and affordable housing. Construction began; and continued at a pace. Until in 2008 the work simply stopped. Investors pulled out. Jobs were lost. And the site lay silent for three years.

‘But last year, something exciting happened. Construction began again. Today, 230 people are working here at 1 Commercial Street to complete the development – and it will open its doors next year. I’ve brought you here because this building is a physical reminder of what our economy has been through in the last six years.’

Work on the development did indeed stop in October 2008, when the concrete frame had been built as far as the 11th floor. It took three and a half years and a change of owner before housebuilder Redrow restarted work on the tower in May 2012.

So far, so good for the Osborne narrative. Work stalled by the credit crunch is finally underway but work on what? What does 1 Commercial Street really say about the nature of the recovery he was proclaiming?

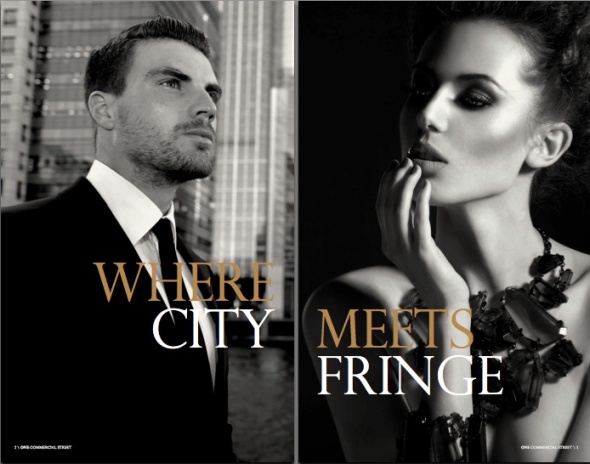

First, the two- and three-bedroom apartments in the development are currently on sale at prices ranging from £720,000 to £1.4 million. The penthouse apartments, which will presumably be priced at significantly more than that, are ‘coming soon’. Those kind of prices for the 137 private properties in the scheme suggest that the restart of work has much more to do with the boom in prime London property as a safe haven investment than the UK economy. Here is a flavour of the marketing message from the brochure:

Second, as with many other luxury London developments, many of the apartments were marketed to overseas investors before being put on sale here. According to Redrow’s 2012 annual report:

‘Following a successful launch in the Far East in February this year, over 40% of the private properties were exchanged for sale. One Commercial Street was then launched in the UK at a spectacular event at The Gherkin.’

Defenders of overseas sales claim that such ‘investment’ enables developments to go ahead, delivering homes for UK buyers and renters that would not otherwise have been built. Detractors point to the way that swathes of Central London are being bought up by the global super-rich as investments rather than places to live.

Third, the development does at least have affordable housing on site, in contrast to many other high-end London schemes that have watered down their section 106 agreements to next to nothing on viability grounds. Redrow’s annual report says that a contract with Network Stadium Housing Association was exchanged for the 70 affordable apartments in March 2012. However, that implies that public investment in housing was crucial to getting the scheme moving again. The timing also implies that the flats will be for ‘affordable’ rent at the cost of a mounting housing benefit bill. Neither seems a message Osborne would want to convey.

Fourth, before anyone gets too carried away with the idea that this is a revival of the pre-2007 idea of mixed communities, it is anything but. Prospective purchasers of the private apartments are promised in Redrow’s brochure that they will ‘arrive in style’ through a residents entrance lobby and dedicated residential lifts. Should any super-rich investors be concerned that they will have to mix with ordinary Londoners in the process, they can rest assured that they will have ‘the exclusive use of the impressively stylish entrance lobby’. The plans show a separate, much smaller ‘dedicated entrance to affordable units’ (which are on separate floors) to which you literally have to turn a corner to the other side of the building. Osborne may well be familiar with the concept of a tradesman’s entrance but this one sounds like a 21st century version of the brick wall built down the middle of a housing estate.

Fifth, the prices of the apartments and the restart of work on the development raise questions about Osborne’s attack later in his speech on critics who have claimed we are seeing ‘the wrong sort of growth’:

‘Some have questioned whether new risks are emerging in the housing market. This debate would benefit from a little less assertion and a little more examination of the evidence. House prices are down a quarter from their peak in real terms, and relative to earnings they are back at 2003 levels. Mortgage approvals are running at only a little more than half, and transactions a little more than two-thirds, of pre-crisis levels. That is why the government’s Help to Buy scheme is a sensible, time-limited and necessary financial intervention to fix a specific financial problem: the dramatic reduction in the availability of high loan-to-value mortgages.’

In terms of the UK as a whole, the chancellor may be correct. According to the latest Nationwide house price index does show that prices have fallen by 9 per cent in nominal terms and 25 per cent in real terms since their peak in 2007. However, that is just one measure: official ONS statistics show that average UK prices are back to 10 per cent above their 2007 peak in nominal terms.

Meanwhile concern about a bubble is currently centred on the London market. If prices at 1 Commercial Street were really still down by 25 per cent in real terms on 2007, the site would most likely still be in mothballs. Average prices in the capital are now back to 24 per cent above their 2007 peak, according to the ONS.

Osborne claimed that Help to Buy will tackle the main barrier to many people getting into the market: raising a deposit. He said: ‘90% and 95% LTV mortgages are not exotic weapons of financial mass destruction – they are a regular part of a healthy mortgage market and an aspirational society.’ He also quoted a report from Morgan Stanley estimating that Help to Buy will boost housing starts by 30 per cent between 2012 and 2015.

Without rehearsing all the arguments against Help to Buy, or repeating the point that even a 30 per cent increase will still leave a huge supply shortfall, there is one huge point that Osborne’s speech strangely neglects to mention. The economy as a whole, and the housing market in particular, are still on the life support of 0.5 per cent base rates and a range of government support schemes like Funding for Lending.

Osborne sees ‘tentative signs of a balanced, broad based and sustainable recovery, but we cannot take this for granted’. Help to Buy relies on extra borrowing and housing transactions delivering a boost to the economy by the time of the next election. What happens when the scheme is withdrawn and mortgage rates rise?

1 Commercial Street is undoubtedly a symbol of what went wrong in the economy leading up to the crisis of 2007/2008: an unsustainable boom in borrowing followed by a credit crunch. Was Osborne’s choice of venue a symbol of sustainable recovery or of lessons that have not been learned?

Really good set of points around the issue of who the recovery is for.

Reblogged this on paul8ar.

we live in a divided world just like the eighties.

Come on Jules, you know as well as anybody that the Housing Association is as likely to have demanded a separate entrance in order to separate management regimes.

A shared entrance would, presumably, have required them to contribute to the 2, 24/7, concierges and the higher quality of finishes, maintenance and additional services such private residents demand – and pay for. A separate entrance ensures costs are kept under control for the affordable homes.

Now, if we built streets…..

Fair points, John – though doubt a housing association alone could make a decision like that with major impact on the design of the building and therefore overall cost. There have also been notorious cases of streets with a wall separating the council and private housing