The state of the housing nation 2023

Posted: December 18, 2023 Filed under: Bedroom tax, Energy efficiency, Private renting, Tenants, Tenure change | Tags: English Housing Survey Leave a commentAs 2023 draws to a close, what is the state of the housing nation?

As always, the best place to start is the English Housing Survey, which has just published headline results for 2022/23. Here are five things that caught my attention.

1 The tenure and wealth gap

The results of the survey need to be treated with more caution than usual when comparing the results this year thanks to the impact of the pandemic, but the general trend on housing tenure is pretty clear.

Thanks in part to Help to Buy and other government schemes, the proportion of households who own their own home (64 per cent) has stabilised while the relentless growth of the private rented sector (18 per cent) has slowed. The social housing sector is still in slow decline but there is a significant difference between London (where it is home to 21 per cent of households) and England as a whole (16 per cent).

There were 874,000 recent first-time buyers in 2022/23 and they had an average (mean) deposit of just over £50,000.

Given that, it’s not surprising that family wealth has become increasingly important to people’s chances of buying. A growing proportion received help from family or friends (36 per cent, up from 27% in 2021/22 and 22 per cent in 2003/04) while 9 per cent used an inheritance for a deposit.

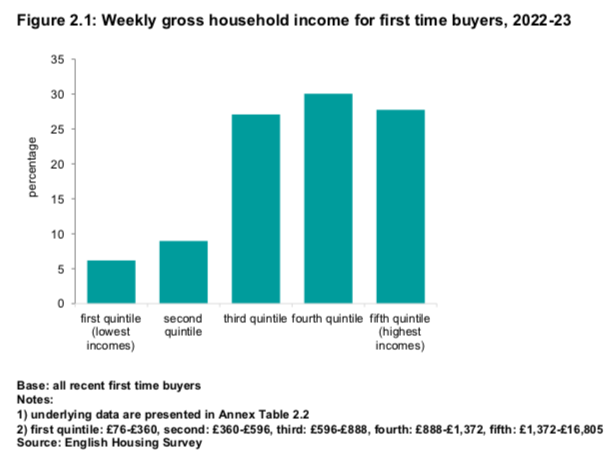

They were also higher earners: the majority of successful first-time buyers (58 per cent) came from the top two income quintiles and only a small minority (16 per cent) came from the bottom two.

Action for now, solutions not yet

Posted: May 26, 2022 Filed under: Benefit cap, Cost of living, Energy efficiency, Local housing allowance Leave a commentThe £15 billion energy cost support package announced by Rishi Sunak rightly benefits the poorest households most but it remains to be seen what it will do about the cost of living in general and the cost of housing in particular.

Under the package announced by the chancellor on Thursday, 8 million households on benefits will get a one-off payment of £650 paid in two lump sums in July and the Autumn. Add that to the £400 energy support payment (rather than a loan) that will go to everyone and the £150 payment already made (at least in theory) to those in Bands A-D for the council tax, and the Treasury says this amounts to £1,200 help towards the cost of living for the most vulnerable.

Background documents confirm the one-off payment will not count towards the benefit cap, unlike the £20 a week uplift to universal credit during the pandemic. That should avoid many more households seeing the help disappear as fast as it arrives.

Sunak had been under pressure to do more on benefits not just because of energy costs but also because of the large gap between the 3.1 per cent uprating of benefits in April (based on last September’s inflation rate) and the current 9 per cent rate of CPI inflation.

He said his one-off payment would be worth more than bringing forward next year’s uprating of benefits, as some had suggested.

And he also confirmed that the April 2023 uprating will be based on next September’s inflation rate, which could easily be more than 10 per cent, rather than retaining the option of declaring it to be unaffordable.

So far, so good, then and this is probably the package that the chancellor should have delivered in a Spring Statementthat looked inadequate at the time and has seemed even weeker with each passing week. This package looks to be both more generous and more redistributive than many people were expecting.

However, that also reflects the scale of the cost of living crisis. Add the £800 increase in the energy price cap expected in October to the £700 increase already seen in April and that is already more than the chancellor’s £1,200 for the most vulnerable and that is before you get to large increases in the price of food, fuel and other essentials.

And there was one major cost that was as absent from Sunak’s statement this week as it was from the one he made in March and the Queen’s Speech earlier this month. No prizes for guessing it must be housing.

Read the rest of this entry »The political choices on homelessness

Posted: February 28, 2022 Filed under: Homelessness, Local housing allowance, Universal credit Leave a commentEveryone In was one of the few success stories in housing policy this century but all that progress in tackling homelessness is about to go into reverse.

The stark warning in the latest Homelessness Monitor for England from Crisis is that levels of core homelessness will have gone up by a third between 2019 and 2024 if nothing changes.

If the reasons for the forecast are not hard to guess, the contrast with the progress made at the start of the pandemic when 37,000 people sleeping rough or at risk of doing so were given accommodation makes this even more depressing. So too the contrast between England and the continuing ambitions of devolved governments elsewhere in Britain to end homelessness altogether.

Rough sleeping was down 33 per cent and sofa surfing down 11 per cent in England in 2020 after that extraordinary initial effort under Everyone In but it soon morphed from a policy into branding for an initiative.

The result was that core homelessness (which means the most acute forms of homelessness including rough sleeping, sofa surfing and being in temporary accommodation) was also down 5 per cent on 2019 levels at 203,400 in 2020.

The Homelessness Reduction Act 2017, another success story, also helped single homeless households, although the report points to weaknesses including continued lack of entitlement to accommodation for some groups (another issue being addressed elsewhere but not England).

So the good news is that the pandemic saw a welcome interruption in the upward trend in homelessness since 2012.

That’s backed up by the latest figures published this week showing that the number of rough sleepers fell for the fourth year in a row in the government’s latest annual snapshot survey – and by the repeal of the Vagrancy Act.

The bad news is that most of the support introduced during the pandemic has since been reversed, with the uplift withdrawn, LHA rates refrozen despite rising rents and mounting concern that evictions could rise sharply in 2022.

Read the rest of this entry »Benefit cap surge is a warning of worse to come

Posted: August 7, 2020 Filed under: Benefit cap, Coronavirus, Local housing allowance Leave a commentOriginally published as a column for Inside Housing on August 7.

Step away from planning reform for a few moments and grim news out today (Thursday August 6) reveals a more immediate crisis in the benefits system with even more alarming implications for the future.

Figures published by the Department for Work and Pensions (DWP) show that the number of households subject to the benefit cap almost doubled to 154,000 between February 2020 and May 2020. Of those, 140,000 had children.

More households have moved on to Universal Credit over time so the grey line for total capped households is the one to watch – note that the increase is much bigger than when the benefit cap was reduced in 2016.

Embracing beauty

Posted: January 30, 2020 Filed under: Housebuilding, Planning, Welfare reform | Tags: Building Better Building Beautiful Commission Leave a commentOriginally published on January 30 on my blog for Inside Housing.

It is very easy to be cynical about this week’s final report from the Building Better, Building Beautiful Commission report.

From the references to Kant to the plans for a fruit tree with every new house, Living with Beauty is full of the thinking you might expect from a group that was chaired by the late Sir Roger Scruton.

And it’s not hard to see how a system based on asking for beauty and refusing ugliness could result in the word ‘beautiful’ becoming as debased as ‘sustainable’ and ‘affordable’ by the time developers have worked out how to exploit it.

To cite one example that jars, the recommendations chapter of the report opens with a picture of Elephant Park in London, which may be an example of good design and greenery but is also the archetypal one of a community displaced in the name of ‘regeneration’ and social housing replaced by highly profitable market sale.

Yet for all that this is an important report that offers fresh support for attempts to move away from the speculative housebuilder model of development and replace it with a longer-term model that could put the meaning back into all three terms.

10 things about 2019 – part two

Posted: December 31, 2019 Filed under: Decarbonisation, Housebuilding, Permitted development, Temporary accommodation, Welfare reform Leave a commentOriginally published on December 27 on my blog for Inside Housing.

The second part of my look back at 2019 runs from welfare homelessness to decarbonisation via housebuilding and permitted development.

5) ‘The systematic immiseration of millions’

The election result means that universal credit, the benefit cap, the bedroom tax and all the other welfare ‘reforms’ of the last decade are set to continue into the 2020s.

Chancellor Sajid Javid told us in the September spending round that austerity is over but the only hard evidence of this was an extra £40m for discretionary housing payments and previous cuts are still baked in to the system.

The election had delayed a full spending review until 2020 but better news came in November as the Conservative manifesto confirmed an end to the four-year freeze in most working age benefits, including the local housing allowance.

It remains to be seen, though, whether the government will restore the broken link with rents. It’s also worth noting that Esther McVey, the self-styled architect of Blue Collar Conservatism, called for part of housing benefit to be diverted into Help to Buy during her brief tilt at the Tory leadership.

I blogged about the deeper impacts on the housing system in a post from the Housing Studies Association conference in May that highlighted research on the ‘housing trilemma’ facing social landlords between their social mission, business imperatives and the impacts on tenants.

And the same month brought a damning external review from the United Nations Special Rapporteur on Extreme Poverty that warned of ‘the systematic immiseration of millions’.

Professor Philip Alston noted ‘a striking and complete disconnect’ between the picture painted by ministers and what he had heard and seen from people across the UK.

As for the chief architect of it all, the year finished with the decade summed up in four words: Sir Iain Duncan Smith.

How ‘temporary’ became permanent

Posted: August 21, 2019 Filed under: Homelessness, Local government, Temporary accommodation, Welfare reform Leave a commentOriginally published on August 21 on my blog for Inside Housing.

Today’s report by the Children’s Commissioner on families in temporary accommodation is a shocking indictment of a system that has become institutionalised into permanence.

If you judge it by the types of building involved – the shipping containers and converted office blocks that make most of this morning’s press coverage – and you have the physical manifestation of what are almost the opposite of ‘homes’.

For all the effort put into finding ‘meanwhile’ sites for containers and despite the fact that some schemes are well designed and that many other forms of temporary accommodation are much worse, just look at the headlines for what the media makes of it.

Children’s Commissioner for England Anne Longfield speaks of containers that are ‘blisteringly hot in summer and freezing in the winter months’ and of ‘homes’ in office blocks converted under permitted development that are barely bigger than a parking space.